The Property Association Guide: Understanding How Mortgage Calculators Work in the UK

Welcome to The Property Association’s guide on how mortgage calculators work in the UK. Whether you’re a first-time buyer or looking to remortgage, understanding how to use a mortgage calculator is essential for planning your property investment. In this guide, we’ll break down the process step by step, explaining what factors go into calculating your mortgage payments, and discussing how choosing the right mortgage term can impact your finances and capital growth.

What is a Mortgage Calculator?

A mortgage calculator is a tool that helps you estimate your monthly mortgage payments, based on several key factors, including the loan amount, interest rate, and repayment term. It’s an invaluable resource for anyone planning to buy a property, allowing you to budget effectively and compare different mortgage options.

The Mortgage Calculator Tool

How Mortgage Calculators Work

Mortgage calculators in the UK generally work by taking the following inputs:

- Loan Amount (Principal): The total amount of money you borrow to buy the property.

- Interest Rate: The percentage rate charged on the loan. This could be a fixed rate (stays the same throughout the mortgage term) or a variable rate (can change over time).

- Mortgage Term: The length of time over which you agree to repay the mortgage, typically ranging from 10 to 40 years. Another useful resource is the PA Property Jargon guide!

- Repayment Type:

- Repayment Mortgage: Your monthly payments cover both the interest and the principal, so by the end of the term, the entire loan is paid off.

- Interest-Only Mortgage: Your monthly payments cover only the interest, and the principal remains outstanding, to be paid off at the end of the term.

- Deposit: The amount of money you pay upfront, typically a percentage of the property price.

Calculating Monthly Mortgage Payments

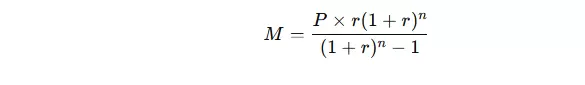

Mortgage calculators typically use the following formula to calculate monthly payments:

Where:

- M = Monthly mortgage payment

- P = Loan amount (Principal)

- r = Monthly interest rate (annual rate divided by 12)

- n = Total number of payments (mortgage term in years multiplied by 12)

Example Calculation

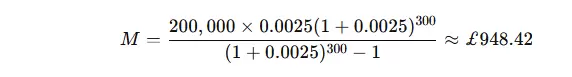

Let’s say you want to borrow £200,000 to buy a property, with a 3% annual interest rate over a 25-year term:

- Loan amount (P): £200,000

- Annual interest rate: 3% (so monthly interest rate is 0.03/12 = 0.0025)

- Mortgage term (n): 25 years (25 x 12 = 300 months)

Using the formula:

So, your estimated monthly payment would be approximately £948.42.

Learn more about how to invest in property in the UK with our guide.

Additional Factors Considered by Mortgage Calculators

- Stamp Duty: Some calculators include the cost of stamp duty, which is a tax you pay when buying a property.

- Additional Costs: Such as legal fees, survey costs, and home insurance.

- Overpayments: Some calculators allow you to factor in the possibility of making overpayments, which can reduce the loan term and the total interest paid.

What is a Good Mortgage Term?

The mortgage term you choose can significantly affect your monthly payments and the total amount of interest you pay over the life of the loan.

- Shorter Mortgage Terms (10-20 years):

- Pros: Higher monthly payments but significantly less interest paid over the term. Your property is paid off faster, which means you build equity quicker.

- Cons: Higher monthly payments might strain your budget.

- Longer Mortgage Terms (25-40 years):

- Pros: Lower monthly payments, making the mortgage more affordable in the short term.

- Cons: You pay much more in interest over the term, and it takes longer to build equity.

How Mortgage Term Affects Capital Growth

- Faster Equity Growth: With a shorter mortgage term, you pay off your mortgage faster, which means you own more of the property outright sooner. This can be advantageous if property values rise, as your equity (the portion of the property you own) will increase more quickly. Why not use our handy rental yield calculator?

- Impact on Investment Strategy: If you’re an investor, a shorter term might be beneficial for capital growth, especially if you plan to sell the property in a rising market. However, the higher monthly payments could limit your ability to invest in additional properties.

- Long-Term Flexibility: A longer mortgage term might give you lower payments and more flexibility in managing other expenses or investments, but it also means slower equity accumulation and higher overall interest costs.

Understanding Mortgage Calculators

Understanding how mortgage calculators work and choosing the right mortgage term are crucial steps in making informed property investment decisions in the UK. A mortgage calculator can help you assess your affordability, compare different mortgage products, and plan your budget effectively. Meanwhile, selecting the appropriate mortgage term is a balance between immediate affordability and long-term financial health, particularly concerning capital growth. A useful resource is the Mortgage Advice Bureau, who assist in searching the market for the best deal.

For personalized advice on mortgage options and property investment strategies, the team at The Property Association is here to guide you every step of the way.

We offer a bespoke Property Membership service as well as free tools for property experts! Learn more on our, Why join the Property Association page.