The Property Association Guide: Understanding and Calculating Rental Yields in the UK

Welcome to The Property Association’s comprehensive guide on understanding and calculating rental yields in the UK. Whether you’re a seasoned investor or just dipping your toes into the property market, knowing how to calculate rental yields is crucial to making informed decisions. This guide will walk you through the process step by step, explain what constitutes a good rental yield, and explore the relationship between rental yield and capital growth. We have also published a useful tenants guide as well as a guide on buying & selling property!

What is Rental Yield?

Rental yield is a percentage that represents the return on investment (ROI) from a property in relation to the rental income it generates. It’s an essential metric for landlords and property investors as it provides a clear picture of how much income you can expect from your investment property.

Types of Rental Yield

- Gross Rental Yield: This is the simpler and more commonly used method. It doesn’t take into account costs or expenses associated with owning the property.

- Net Rental Yield: This method provides a more accurate picture by accounting for expenses such as mortgage payments, maintenance costs, property management fees, and other outgoings.

The Property Association developers have created a useful tool for working out Rental Yields. Please see the rental yield calculator below.

Rental Yield Calculator Tool

How to Calculate Gross Rental Yield

Step 1: Calculate the Annual Rental Income

- Determine how much rent you charge (or expect to charge) per month.

- Multiply this by 12 to get the annual rental income.

Step 2: Determine the Property Value

- This can be the price you paid for the property or its current market value.

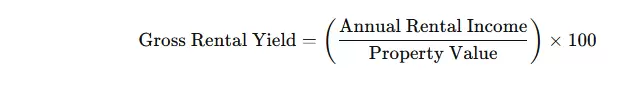

Step 3: Calculate the Gross Rental Yield

- Use the following formula:

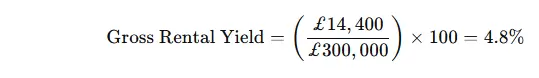

Example:

- Monthly rent: £1,200

- Annual rental income: £1,200 x 12 = £14,400

- Property value: £300,000

How to Calculate Net Rental Yield

Step 1: Calculate the Annual Rental Income

- As in the gross yield % calculation, find your annual rental income.

Step 2: Deduct Annual Expenses

- Include costs such as mortgage interest, maintenance, insurance, management fees, and any other expenses related to the property.

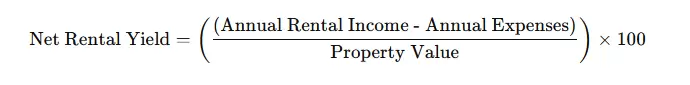

Step 3: Calculate the Net Rental Yield

- Use the following formula:

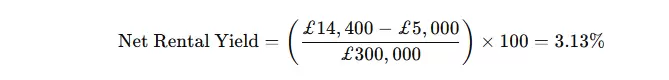

Example:

- Annual rental income: £14,400

- Annual expenses: £5,000

- Property value: £300,000

What is a Good Rental Yield?

- 3% – 5%: Generally considered average for properties in areas with strong capital growth potential. This is common in prime locations, like London, where property values are high, but rental yields are lower due to the higher costs of buying.

- 5% – 7%: A strong rental yield, is often found in cities or towns where property prices are more affordable relative to the rent that can be charged. This is often seen as a good balance between rental income and the potential for capital growth.

- Above 7%: Considered high, indicating a potentially profitable rental property. However, high yields often come with higher risks, including less stable rental income or properties in areas with lower capital growth prospects.

Rental Yield vs. Capital Growth

Rental yield and capital growth are often seen as two sides of the property investment coin.

- Rental Yield: Focuses on the income generated from the property.

- Capital Growth: Refers to the increase in the property’s value over time.

High Rental Yield Areas:

- Typically, areas with high rental yields tend to have lower capital growth. These are often regions where property prices are low, but rental demand remains strong.

Low Rental Yield Areas:

- These are usually areas with high property prices and lower rental income. However, these yield hotspot areas often experience higher capital growth over time, making them attractive for long-term investment.

Balancing the Two:

- The best investment strategy often involves finding a balance between rental yield and capital growth. This balance ensures steady cash flow from rental income while also benefiting from the property’s appreciation in value.

Understanding rental yields and how to calculate them is vital for making informed investment decisions in the UK property market. Whether you prioritize rental income, capital growth, or a balance of both, calculating rental yields accurately will help you align your investments with your financial goals. Read more about how to invest in property with our guide.

For more advice on property investment, market trends, or personalized guidance, The Property Association team is here to assist you every step of the way. There are some good statistics on the Zoopla website that are useful.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice. Property investments come with risks, and it is recommended to consult with a qualified financial advisor before making any investment decisions.

Why not check out the Property Association members area today?

Latest Members: Prime Location – RWinvest – OnTheMarket & Nestoria